What happened with Archegos Capital?

April 7, 2021 Update: Since this post went up last week, Credit Suisse revealed their losses were worse than the up $4 billion anticipated. The firm is writing down $4.7 billion due to its Archegos exposure, cutting its dividend, suspending share buybacks, and removing senior executives, including investment bank head Brian Chin and risk chief Lara Warner. Reporting also revealed that Archegos had turned $200 million into $20 billion in assets before it all imploded. He used an increasingly dangerous strategy: every time his leveraged bets went well, he'd put the profits back into trades with even larger leverage. This wasn't just a risk for Archegos, but one to the banks extending this leverage to the firm. As one anonymous bank executive told the Financial Times, “‘It’s pretty hard for me to defend why we loaned him so much,’ said an executive at a bank with billions of dollars of exposure to Archegos.” This all leaves some serious questions (like those I raise below) about gaps in reporting, and what went wrong in the risk mangement at these major banks.

Last week, ViacomCBS positively tanked, losing half its value in more than a week. But Viacom's woes turned into a $33 billion, market-wide asset liquidiation event thanks to the holdings of a family fund Archegos Capital, run by Sung Kook (“Bill”) Hwang.

Why the troubles at Archegos led to market-wide fire sales is due to a combination of things:

- What Arechegos was trading (derivatives that mimic stocks, called Total Return Swaps), and the leverage Archegos employed in doing these trades;

- Who Archegos was trading with (a number of large banks);

- The lack of disclosures. Many banks were on the same side of the same trade, which exacerbated the firesale. But that fact appeared largely unknown till it all went bust.

What was Archegos Capital doing?

Reporting indicates that Archegos' long positions were concentrated in about eight names:

- ViacomCBS (VIAC)

- Discovery Inc. (DISCA)

- Tencent Music Entertainment Group (TME)

- GSX Techedu Inc. (GSX)

- Baidu Inc. (BIDU)

- Farfetch Ltd (FTCH)

- Iqiyi Inc. (IQ)

- Vipshop Holdings Ltd. (VIPS)

But Arechgos wasn't buying stocks in these companies. Instead, perhaps in order to avoid the kinds of disclosures that are required when you hold a certain amount of stocks, Archegos used derivatives that mimick the performance of stocks, but don't have the same disclosure requirements. One of the derivatives they used are called Total Return Swaps (TRS), also known as an "equity swap."

Sidebar: What is a Total Return Swap (TRS)?

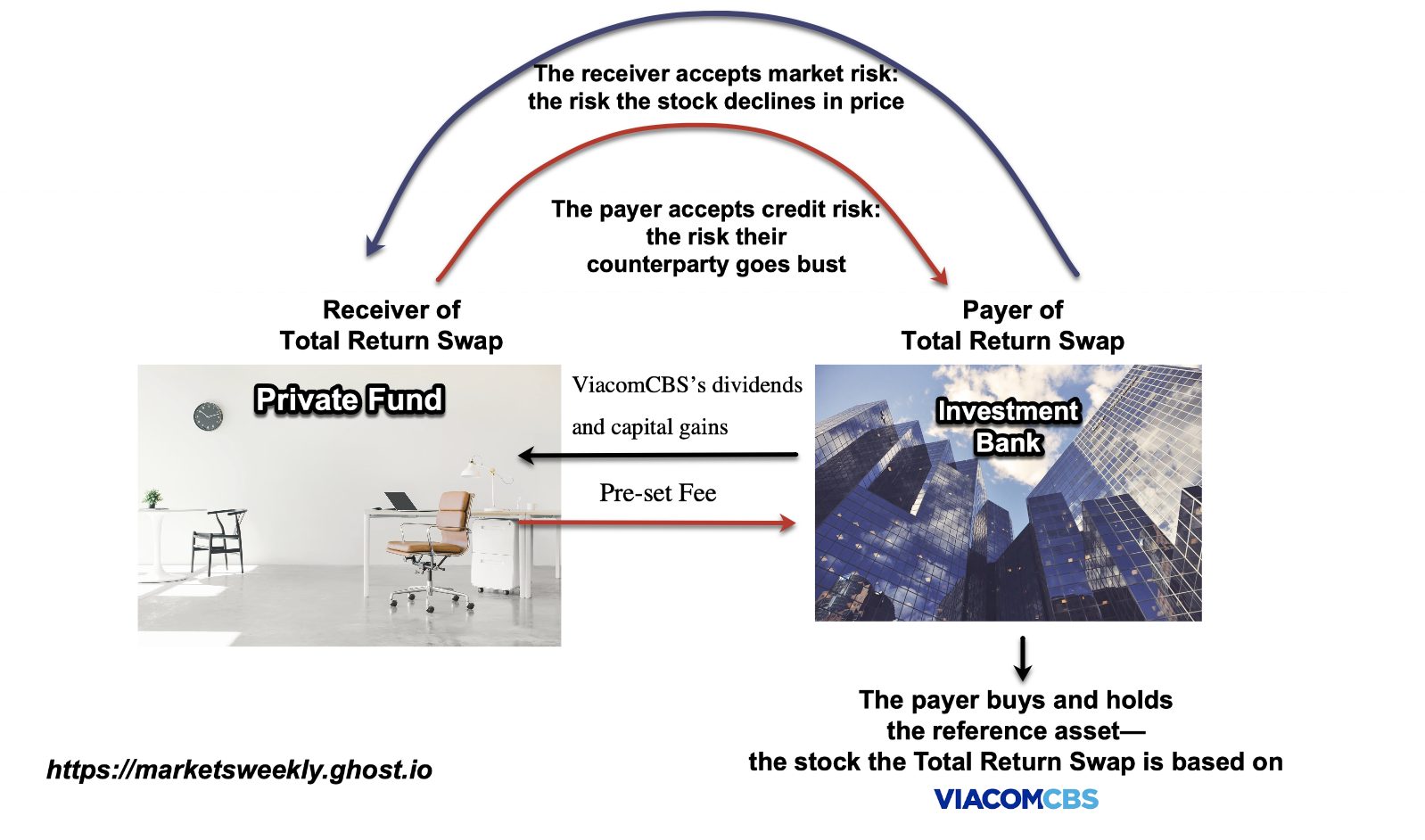

You can think of a TRS as a financial product that provides nearly the same economic payoffs as a stock – but it isn't a stock, it's a swap. Swaps are financial instruments where two parties "swap" payments. (You can read more about swaps here).

In a Total Return Swap:

- One party makes makes payments based on the return of an underlying “reference” asset.

- The other party makes payments based on a pre-set rate.

This arrangement allows the receiving party to receive all the economic benefits of a reference asset (like a stock’s income and capital gains), without actually owning the asset.

Why might you do this? One might do it to try and avoid taxes of owning the stock outright. You might do it to gain access to a stock in a country that you have to live in to purchase. You might do it because it's a highly leverage trade--allowing you to get large exposure to a stock without needing to put up the money to buy the stock (as it seems Arechegos may have done). Or, you might do it to avoid disclosing what you own to the public.

But this arrangement creates credit risks for the TRS payer. And that risk broke wide open last week for Archegos' counterparties, which included a number of major banks.

Who was Archegos trading with?

Archegos had what's called a prime broker relationship with a number of major banks, including Goldman Sachs, Morgan Stanley, Credit Suisse, UBS and Nomura.

Sidebar: What's a prime broker?

Large banks offer a number of bundled services to hedge funds and large private funds through an offering called Prime Brokerage. These services can include: borrowing securities (via securities lending) executing trades (including trades that use leverage), and cash management. (If you'd like a concrete example, here's a PDF from Morgan Stanley markeing their prime brokerage offering.)

ViacomCBS started tanking, leading to a margin call

Reporting has shown that Arechgos held Total Return Swaps on the eight stocks listed above with all of its prime brokers. In order to manage their risk, the banks demand collateral to demonstrate that Archegos wouldn't go under should their trade move against them.

When ViacomCBS shares started tanking, one (or more) of Archegos' prime brokers hit them with a margin call – which they couldn't meet.

Sidebar: What's a margin call?

When a position begins to move against you, your broker will typically demand that you deposit additional money or assets into your account, enough that the value of your account reaches a certain value, known as the maintenance margin. This is a margin call.

A $33 billion firesale

When Archegos failed to meet its margin call, the banks with trading relationships with Archegos needed to begin to unwind the massive positions. But since they all needed to sell shares of the same eight stocks, there was no way to do it without moving the market.

And move the market they did! Here's the daily charts of just four of the stocks (BIDU, VIAC, TME, GSX) that Archegos had derivative positions in, over the last week:

Archegos counterparties, once they had a handle on what was happening, actually met to try and figure out how they could all offload giant blocks of the same stocks in a way that would disrupt the market the least. The Financial Times reported:

Before the troubles at the family office burst into public view at the end of the week, representatives from its trading partners Goldman Sachs, Morgan Stanley, Credit Suisse, UBS and Nomura held a meeting with Archegos to discuss an orderly wind-down of troubled trades.

But it seems Morgan Stanley and Goldman Sachs moved first, perhaps trying to sell before the other banks did, and stem their losses as the market began to move against the names they all needed to offload:

“It was like a game of chicken,” one person said.

By Friday morning, any hopes of co-ordination had been snuffed out and the floodgates opened when Goldman began pitching global investors on billions of dollars of Archegos-linked stocks. Morgan Stanley joined hours later, and the two sold roughly $19bn in big block trades that day alone, according to the people.

Further details from the FT:

People familiar with the talks said Goldman Sachs, which was “very exposed” to Archegos, listened to the discussions but did not commit to an agreement on Thursday evening. On Friday morning, the bank pitched a $3.6bn block sale that was quickly increased to $6.6bn. By the end of the day, the bank had liquidated some $10.5bn of securities linked to Archegos, according to people briefed on the matter.

Morgan Stanley has also sold more than $10bn worth of stock tied to Archegos, including roughly $8bn it marketed in big block trades on Friday.

Why were so many prime brokers doing business with someone banned from Hong Kong's trading markets?

Prior to launching Archegos Capital, Hwang plead guilty to wire fraud charges in 2012, and paid $44 million to settled insider trading charges with the SEC that same year. Two years later, he was banned from trading in the Hong Kong markets for 4 years after admitting to using inside information to trade Chinese bank stocks.

Reporting shows that Hwang managed up to $10 billion of the Hwang family’s wealth at Archegos. Archegos' prime brokers allowed the firm to borrow and hold assets many multiples its total size.

Since extending Total Return Swaps to a counterparty carries credit risk with it, it seems likely that Credit Suisse and Nomura are regretting their dealings with Archegos, as they've now both been hit by heavy losses as they unwound their positions with the fund. From Reuters:

Credit Suisse has yet to confirm its losses, but the sources said the Swiss bank faces losses of up to $4 billion. Nomura, Japan’s largest investment bank, warned on Monday of a possible $2 billion loss.

Bank stocks have taken a hit across the board this week, despite Goldman and Morgan Stanley trying to reassure the markets that they got out in time.

What could the SEC do to improve transparency?

While Archegos Capital is not a hedge fund, their use of Total Return Swaps to avoid reporting stock trades on the Form 13F is a technique also utilitized by certain hedge funds in order to avoid the disclosures.

The SEC could act to address this by expanding the range of financial products disclosed by form 13F. This would help regulators and the broader public have a better window into the activities of hedge funds. The SEC could change the reporting on Form 13F to include:

- Short stock positions

- Short option positions

- Total Return Swaps and other equity derivatives that mimic the behavior and payouts of stocks.

Is there a role for Congress in Archegos?

Another issue highlighted by the Archegos situation is the carve out that family funds enjoy from registering under the Investment Advisers Act of 1940. The Dodd-Frank Wall Street Reform and Consumer Protection Act exempted family offices managing solely their own finances this requirement. Congress, together with the regulators, may want to examine if this exemption for family funds like Archegos are creating regulatory blind spots that contribute to systemic risk.