What happened with GameStop?

It's not David vs Goliath. It's Goliath vs. Goliath, with David as a fig leaf

This is a free post from Markets Weekly, a newsletter by former Wall Street professional Alexis Goldstein. If you appreciated this post, please consider signing up here for premium access to all posts.

In early January, GameStop was trading around $18. By close today, it had reached $364.15. An intense buzz has formed in the stock thanks to discussion on the Reddit forum Wall Street Bets, further enhanced by dominant coverage in the media. At least one hedge fund, Melvin Capital, that was shorting GameStop (betting the price would fall) got utterly crushed.

Some cheered the victory of Reddit and Robinhood over Wall Street.

But it isn't so simple.

(If you'd like to skip the explanation and jump to my suggestions for the future, go here.)

This mania started when a popular Reddit forum called Wall Street Bets began writing about some of the most "shorted" retail stocks.

Sidebar: What is "shorting"?

You can bet that the price of a stock will fall by taking on a short position. This requires you to borrow the stock from someone else first. Your broker then immediately sells the stock. Since you think the price will fall further, you're calm, cool, and collected. You wait to the price to fall more, and then you buy the stock back at a lower price, so you can return the shares to whoever you borrowed it from.

Wall Street Bets publicly hatched a plan on the forum to buy and hold GameStop stock, and GameStop call options, in order to drive the price up so high, it would create a "short squeeze." A "short squeeze" is when a price jumps so high that the short sellers are forced to buy back the stock to close out their position (usually due to their broker requiring them to put up more cash because they're losing money so fast. This is a "margin call").

All the attention and momentum from the press brought in more retail traders buying GameStop, and Wall Street itself hopped in for the ride. So many people buying call options also caused the people selling the Robinhood crowd those options to buy the stock in order to "hedge" their bets.

Sidebar: Explain Options to Me

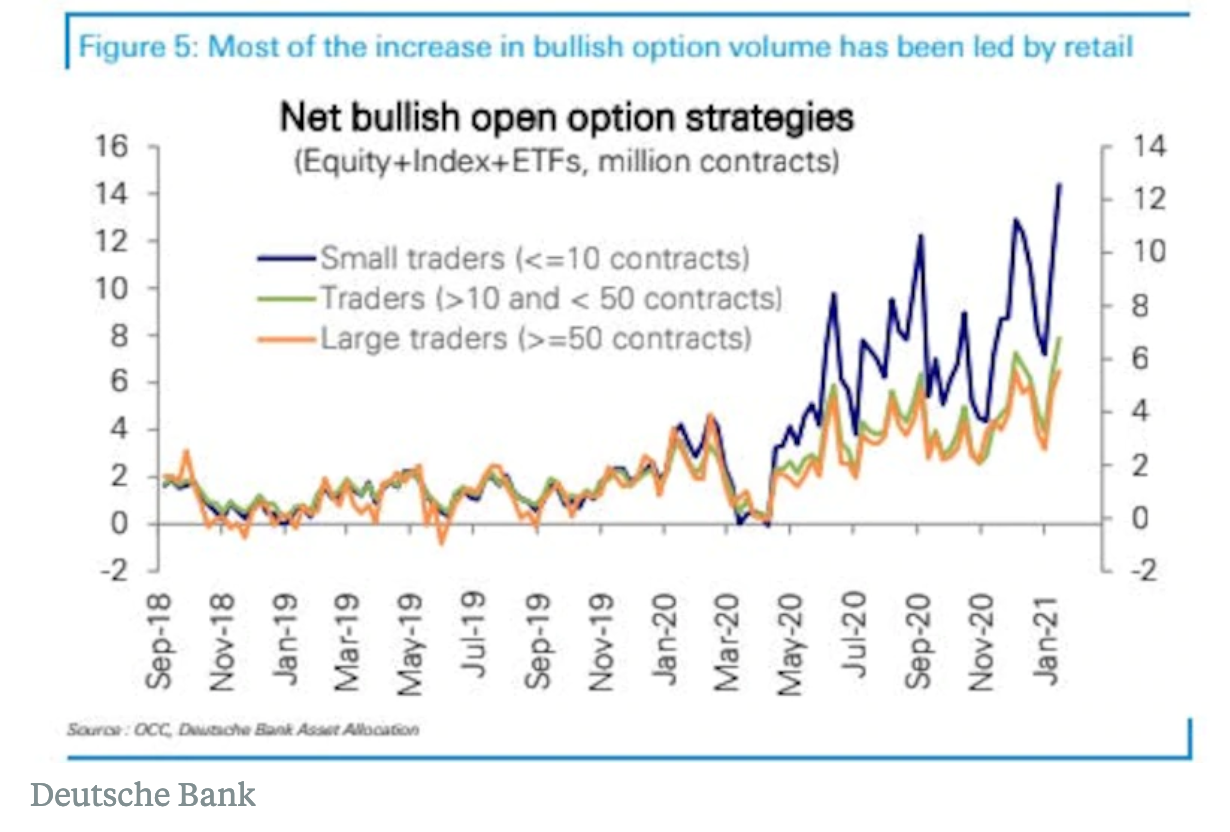

One of the byproducts of both Robinhood and Wall Street Bets has been the popularization of trading options by retail traders.

A stock option is a derivative that gives you the right to buy or sell 100 shares of stock in the future at a set price. The price you have the right to buy or sell it at is the "strike price." The option has an expiration date. It also can be either a Call option (which gives you the right to buy the stock) or a Put option (which gives you the right to sell it).

When you buy a Call option from a market maker, if that market maker doesn't already own the stock, they have to hedge their bet by buying the stock. So not only did you have all of these people on Robinhood buying GameStop stock, many were also buying GameStop call options. That meant the market makers on Wall Street were also buying GameStop stock in order to hedge their position.

It's worth noting that since the start of the pandemic, there's actually been a monumental increase in retail traders buying call options:

All of this drove the price of GameStop into the stratosphere.

We know that many Robinhood and Redditors are profiting off this. But they aren't the only ones.

Citadel pays for order flow from Robin Hood.

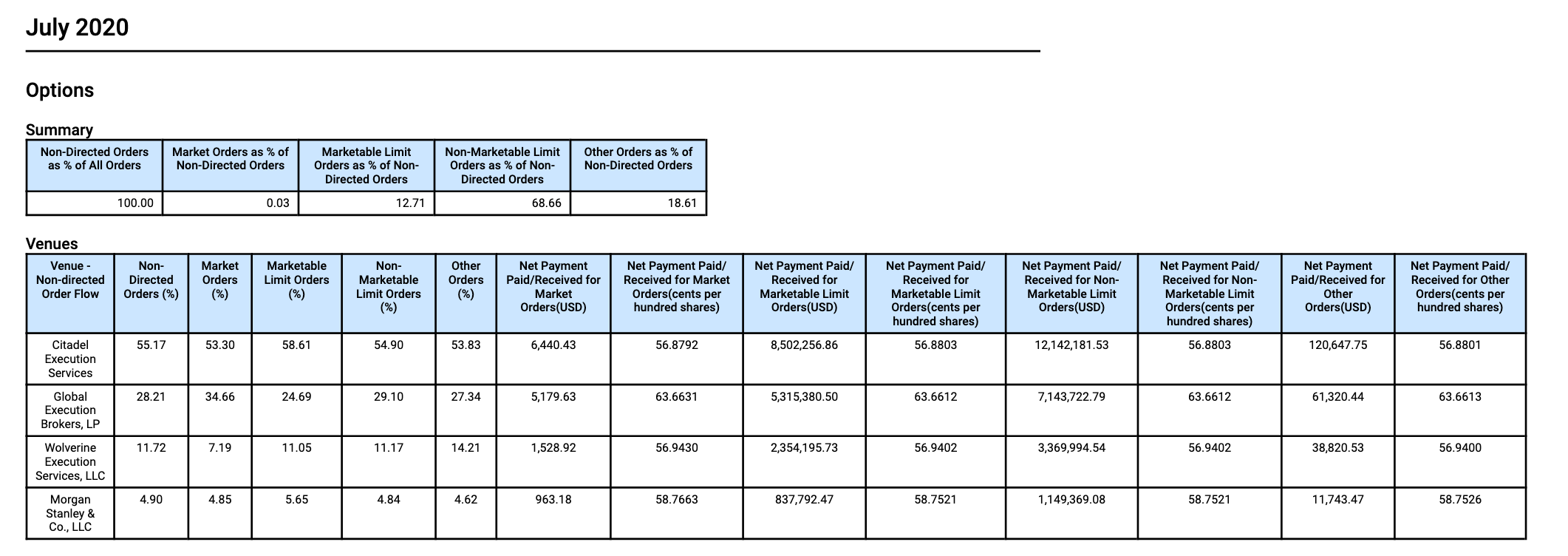

Citadel is a massive hedge fund (founded by billionaire Ken Griffin) with three different firms: a tech firm, an asset manager, and a market maker. The market maker, Citadel Securities, pays Robinhood a pre-set fee for every trade they execute. (It's worth noting that Citadel isn't just any market maker. They're massive: handling almost a quarter of all listed (aka, exchange-traded) stock options.)

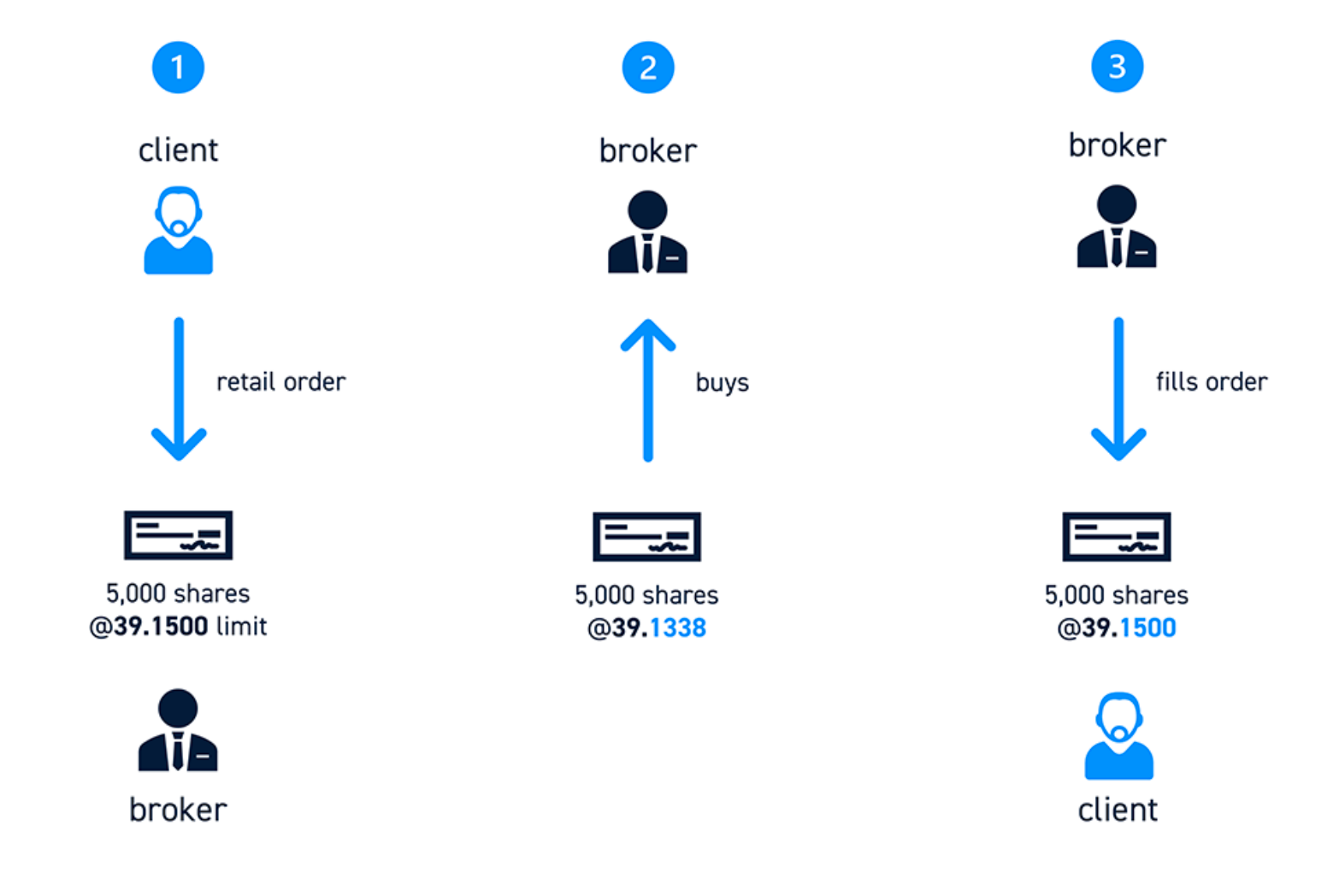

This is what's called a Payment for Order Flow (PFOF) arrangement.

Market markers can profit from these arrangements in a few different ways (read more here if you want the full details). But the best way to summarize it is this: Citadel can batch the Robinhood orders together, leverage its sophisticated high-frequency trading (HFT) algorithms to "front run" (buy shares "in front of" or before your client does) Robinhood trades.

Robinhood traders are generally not buying or selling options in "lots" (batches of 100); they're usually buying one or two or ten options at a time. So Citadel may batch a number of Robinhood users' options together, buy multiple "lots" themselves from another dealer, then fill the batch of Robinhood orders at a slightly worse price that what Citadel paid for it.

Historically, there's been debate about whether or not Payment for Order Flow should even be allowed. The practice was actually originated by none other than Bernie Madoff (the famous ponzi scheme fraudster) in the 1980s. During the Obama administration, the SEC asked one of its market advisory commitees if Payment for Order Flow should be banned.

Citadel has also gotten into trouble with the SEC in the past for the way it handled its Payment for Order Flow: In 2017, they fined Citadel Securities $22.6 million, "saying the firm inaccurately described how it handled trades placed by small investors," according to Bloomberg.

Some, like Institutional Investor magazine (a major Wall Street trade publication) have asked, essentially "who cares?" They noted in June 2020 that "payment-for-order-flow is nothing new" and that the practice is used by "Fidelity, e*Trade, Charles Schwab, and TD Ameritrade, among others, SEC Rule 606 disclosures show."

But unlike the other firms that use this technique—Robinhood doesn’t publish data on how much price improvement it gives customers.

Not only that, but Robinhood wasn't initially honest about this arrangement:

- In December 2020, the SEC charged Robinhood with failing to disclose that it was using this Payment for Order Flow model at all. The SEC also found that Robinhood was failing to provide "best execution" to its clients, thus costing them over $34 million due to "inferior trade prices," even when you factored in zero commissions.

- Even FINRA, Wall Street's self-regulating overseer, also fined Robinhood in 2019 for “best execution violations related to its customers’ equity orders and related supervisory failures.” Robinhood paid a $1.25 million fine, but did not admit or deny any wrongdoing.

Sidebar: What is best execution?

Robinhood is a broker, and as such, is obligated to provide its clients with "best execution" on their trade. This means the broker must put their clients' interests first, and try and get either the best price or fastest execution, and not send their orders to the market maker paying them the best price for order flow.

Citadel is the dominant Market Maker Used by Robinhood

Citadel is not the only market maker that Robinhood uses, but it's the largest one. It accounts for the majority of its stock executions, and more than 55% of its equity option executions, as of July 2020:

Sidebar: What's a market marker?

Market makers are the people who sit as intermediaries between buyers and sellers. When you want to buy, they're there to sell to you. When you want to sell, they stand ready to buy. They make money off of the "flow," and they carefully hedge all the positions they take on in order to manage the risk of their portfolio.

Robinhood, Citadel, Melvin Capital, and Point72

So Citadel is a hedge fund whose Market Making arm is handling the majority of Robinhood orders. Meanwhile, another hedge fund, Melvin Capital, was one of the funds caught in the GameStop short squeeze. This week, they finally had enough, and had to close out their short position for a big loss.

Who stepped in to buy up a piece of Melvin Capital after that happened?

None other than Citadel Securities' parent, Citadel LLC. The WSJ reported on Monday:

Citadel LLC and Point72 Asset Management are investing $2.75 billion in hedge fund Melvin Capital Management, an emergency influx of cash that is expected to stabilize what has been one of the top performing funds on Wall Street.

Who's the other party that gave cash to Melvin Capital? Point72, the new investment advisory firm for Steve Cohen. Cohen's former hedge fund SAC Capital, the firm that pled guilty to insider trading in 2013 (though Cohen himself emerged without admitting guilt). It's also worth noting that Melvin Capital is run by Gabriel Plotkin, who was one of SAC capital's top traders. Cam Karsan has some further thoughts on the Citadel/Point72 rescue of Melvin here.

Wall Street Loves Data

It's important to remember that Wall Street is a data machine. Wall Street will use data from every avenue it can to try to make predictions about what is going to happen next in the market. They hoover up data to feed their models, in order to make valuation decisions, and in order to arrive at what is the best most accurate price of something. I remember one of the traders that I used to work with used to pull up every lot of different news sources including the Drudge Report, which I thought was ridiculous. But he said, "look, I want to get news from every place I can and I want to understand what people from all different kinds of points of view are thinking." Traders seek information and rumors and tips like heat-seeking missiles.

Usually, traders use expensive vendors to supply them with quotes to feed into their models. Some of those quotes come from financial intermediaries (called "inter-dealer brokers") whose only purpose in life is to mask the orders of the big banks, so they can trade with each other with some degree of anonymity. (I learned in my time on Wall Street that with enough pressure, some inter-dealer brokers would admit who was on the other side of the trade).

Wall Street loves data, but they also loathe other people finding out their data and their order flow. That's what's contributed to the rise of dark pools: private exchanges that allow big, institutional investors to send very large trades without impacting the market overall. One question I have about the GameStop situation is, how much order flow for GameStop flowed into dark pools, both during and after market hours?

Why do I mention this? Wall Street usually works very hard to find out what their competitors are doing. With Wall Street Bets, they don't have to work hard at all. It's all being done in the open. So all of these traders on Wall Street know the trading plan of thousands of retail traders. Meanwhile, Citadel, thanks to the Payment for Order Flow arrangement, has even more data than that.

So the question becomes – is this really Robinhood sticking it to Wall Street? And the answer is, no.

This this isn't hedge funds versus retail. It's hedge funds versus other hedge funds (and versus Wall Street "flow" desks, which make money every day, and excel at doing so on volatile days) with retail driving the way forward. Melville Capital may have imploded. But Citadel took part of it over. That's hardly a resounding victory over the biggest titans of finance.

Trump deregulation and market chaos

It's important to remember that the market chaos we have seen from all of this isn't just about a Reddit forum, a slick app, or media buzz. It's also, in some ways, yet another form of Trump-era chaos.

Trump oversaw a massive wave of financial deregulation. Here are just a few examples:

- The Trump administration shut down a working group that was examining the risks that Hedge Funds might pose to the financial system. This working group was housed at the Financial Stability Oversight Council; Treasury Secretary Steve Mnuchin shut it down.

- Trump put a former executive from the cryptocurrency exchange Coinbase in charge of one of the major banking regulators, the Office of the Comptroller of the Currency (OCC). He proceeded to deregulate crypto at banks. As Yahoo Finance detailed, "During his term, the OCC published several interpretive letters or made statements announcing that banks can provide services to issuers of stablecoins, partner with crypto custodians, conduct payments using stablecoins and operate nodes on blockchain networks."

- Trump appointed former OneWest executive Steven Mnuchin, who oversaw massive foreclosures during his tenure, to the Treasury. Trump also appointed a former white shoe law firm attorney Jay Clayton, who defended many Wall Street clients, to run the Securities and Exchange Commission (SEC) which oversees much of the stock and equity options marketplace.

Did the Fed overheat the market?

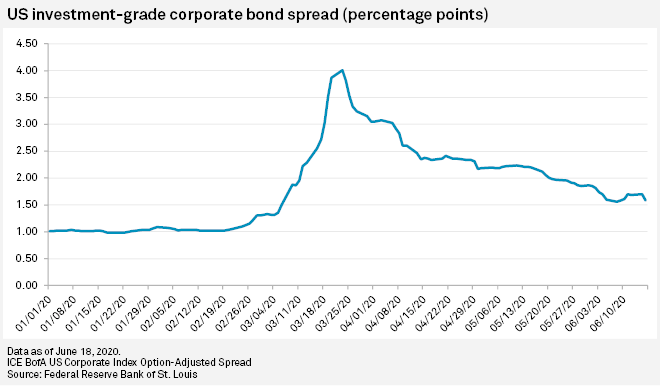

Federal Reserve Chairman Jerome Powell was asked about the GameStop price move on January 27th--and whether the Fed's massive intervention in the corporate bond markets were creating asset bubbles.

Chair Powell said: “I think the connection between low interest rates and asset values is probably something that’s not as tight as people think because a lot of different factors are driving asset prices at any given time.”

But it's undeniable that the Fed's actions in the corporate bond market last Spring brought down credit spreads substantially. This led to lower yields across the fixed income markets writ large, and led many investors to seek returns elsewhere--such as in the equity markets.

As I documented over the summer, these actions led to record-breaking profits for Wall Street trading desks.

Our K-Shaped Recovery

In the end, this GameStop (and Blackberry, and Nokia, and AMC, and whoever else Wall Street Bets targets next) explosion exposes yet another sorry aspect of our K-shaped recovery. We have an overheated equities market still doesn’t translate to higher wages for workers.

Markets are, in theory, supposed to drive innovation and jobs. Instead, whether it's coming from retail traders, or the Wall Street sharks watching and front running them, the deregulatory Trump era seems to have ushered in little more than rampant speculation.

Some Questions for the Future

I believe that the market and financial regulators should consider a few questions going forward:

- Should Payment for Order Flow be banned?

- Are Robinhood and other FinTech brokerages (like Gatsby) providing their clients with Best Execution? (For Robinhood, Finra and the SEC both seemed to think not).

- Should major hedge funds like Citadel be designated as Systemically Important Financial Institutions?

- Regulators should investigate where the intense activity we saw in after hours trading yesterday was coming from. (It is almost certainly not driven by retail).

- Finally, former SEC Chair Arthur Levitt Jr. has some additional suggestions to consider in this piece.

Quick Update as of Jan 28

After yesterday's wild ride with GameStop, Nokia, Blackberry and others surging, this morning Robinhood limited these and other active names like AMC to only closing out positions, not new purchases. Unclear if this is true at other brokerages apart from Robinhood.

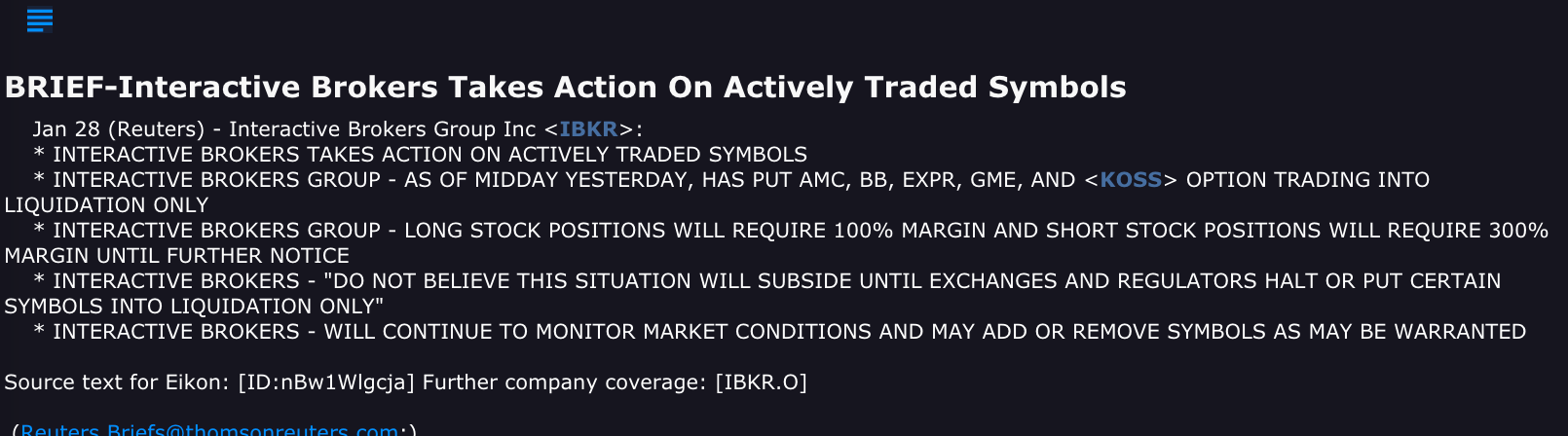

Interactive Brokers is limiting options in these names to just closing positions, and requiring 100% margin for long stock positions on these names – and 300% margin on short positions:

It looks like the Brokerages are worried about massive losses in their client base – on both the up and downside – and some of their users blowing up. A number of Robinhood users didn’t take the action well, and filed a class action complaint against the firm.

This is likely just the beginning of scrutiny into this matter, and Robinhood definitely deserves scrutiny -- for whether its adhering to Best Execution as it sells its order flows to Citadel and others. But let’s hope the regulators also take a close look at the even bigger Goliaths, and figure out what role they’ve played, too.